Inflation and rapidly rising mortgage rates are two major forces shaping the 2022 housing market, resulting in a dramatic realignment of this sector and leaving many to contemplate what's ahead.

This year, the Federal Reserve's attempt to stabilize inflation has caused mortgage rates to skyrocket - a phenomenon not witnessed before in one calendar year. This had an incredible impact on buyer behavior, supply and demand, and eventually home prices; as a result of these sudden changes, some buyers and sellers chose to wait until conditions became more predictable before moving forward with their plans.

Thus, what implications can we anticipate for the forthcoming year? Everyone hopes to witness a secure market in 2023. To guarantee this lasting assurance, The Fed must lessen inflation rates drastically and protect it persistently. Now let us accept insight from esteemed housing sector professionals on what is potentially going to transpire next year!

What Predictions Can We Make About Mortgage Rates in 2023?

As we march into the future, financial experts foresee inflation to remain influential. Mortgage rates and inflation go hand in hand; when one is high, so too is the other. Though recently it appears that inflation might be on a downward trajectory - but don't break out the champagne just yet! Inflation should still be closely monitored come 2023 as this will heavily dictate mortgage rates.

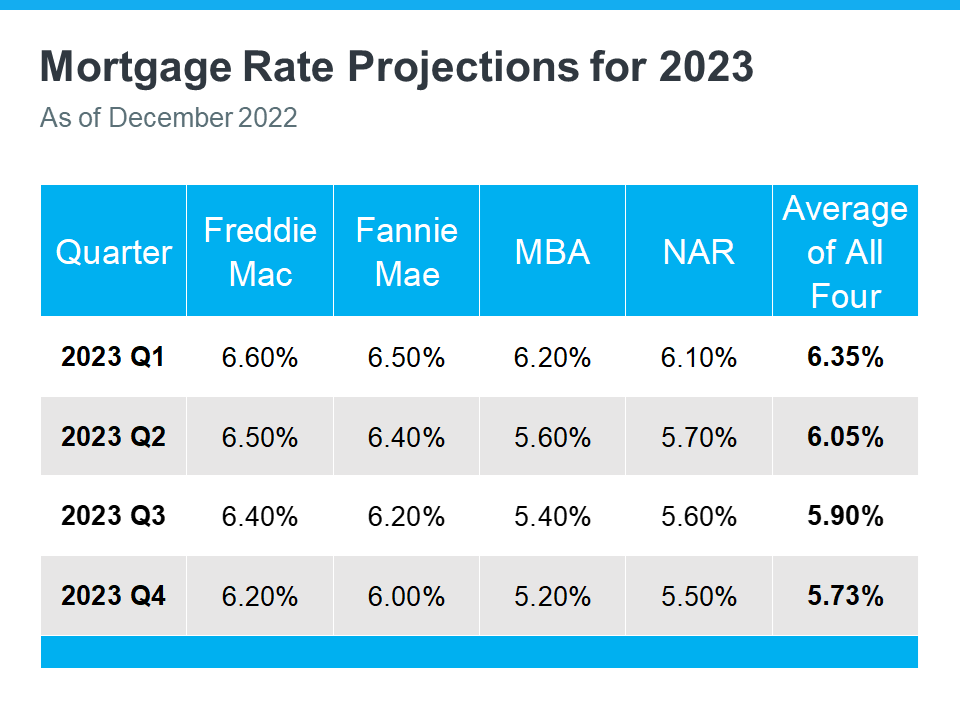

After careful analysis, experts have concluded that mortgage rates should stay relatively stable in 2023 at between 5.5% to 6.5%. Even though predicting the exact rate is nearly impossible, our composite reading of all estimates leads us to believe that security will be found (see chart below):

For the foreseeable future, we can anticipate that rates will remain steady. Then again, if inflationary pressures stay low enough for long enough, there's a potential for further rate decreases in 2023. Greg McBride - Chief Financial Analyst at Bankrate - asserts:

“. . . mortgage rates could pull back meaningfully next year if inflation pressures ease.”

Over the course of the next few weeks, we could very well see fluctuations in rates. Although keeping inflation in check would be a wonderful outcome for housing markets worldwide.

What Will the Housing Market Look Like in 2023?

During the pandemic, it became clear that home prices are driven by the age-old principle of supply and demand. With more buyers than available homes, house values shot up – a consequence we were expecting due to this law but still incredibly remarkable! This case study highlights how this concept applies in real life situations.

This year has been a drastic shift from previous years, with home prices becoming more reasonable and inventory levels growing due to buyers backing out of the market because of higher mortgage rates. These changes are specific to certain areas that had already become overly heated in terms of real estate prices. What do industry specialists anticipate when it comes to these trends?

As depicted by the graph below, predicting home prices for 2023 is a tricky business. The colored bars present diverging opinions; with some experts estimating an increase in house values while others foresee a decrease. Nevertheless, when we take into account all of these projections (marked in green), it can give us a more comprehensive forecast to prepare ourselves better for next year’s market trends.

NAR's Chief Economist, Lawrence Yun, confirms that across the U.S., home value appreciation is expected to remain steady or stay at a neutral rate in 2023.

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

Bottom Line

To accurately predict mortgage rates for 2023, you need a trustworthy real estate specialist to guide you through the process. Inflation could have an effect on those figures - but with my capable assistance, we can stay a step ahead of the trends and keep our estimates up to date. Get in touch so that together we can be prepared for any market developments!